Investing in student property can be a lucrative way to earn money as a landlord. In 2016, a record 535,200 people took up higher education places, which in turns means the demand for quality student accommodation has never been higher.

So where to start? Well the first thing you need to do is forget everything you thought you knew about the standard of students are willing to put up with. The days of the squat student flat are long gone.

Good Wi-Fi, flat screen TVs and ensuite bathrooms are a standard in purpose-built student accommodation, and students are beginning to see these features as a deal breaker when it comes to private education.

“Today’s students will be in debt up to their eyeballs when they graduate, but they often have more ready cash than their counterparts even just a decade ago - and they are more discerning and savvy than ever,” says James Davis, chief executive of the online estate agency Upad.

“From a landlord’s perspective, students represent a lucrative opportunity,” he adds. “Despite popular belief, they are the most reliable tenants as they often have their rent subsidised by student loans or with parents as guarantors.”

The modern student wants a modern house, that’s clean and low-maintenance (no gardens to look after etc.). Avoid buying a period property, as the upkeep and care they require will eat into your profits.

The property’s proximity to the university is its most important selling point. If given the choice between a semi-detached house on secluded housing estate five miles away from the university, or a terraced house on a busy road that’s a five minute walk from their university and social life, you can probably guess which one a savvy student is going to choose.

One of the main benefits of letting to students is the minimised risk of void periods. Student lets are arranged up to six months in advance, and there’s always a constant supply of students who will happily take up the tenancy.

If you’re looking for the right place to buy property, there are a range of areas to choose from. Student numbers in London are nearly 15 times more than the supply of rental property, meaning there’s definitely a market for your student properties. Nearby Brighton also yields high returns on student accommodation.

The north also holds some excellent prospects. Manchester is well known for having the biggest student population in Europe, whilst areas of the North West are seeing nearly double the amount of gross rental yield then property in central London.

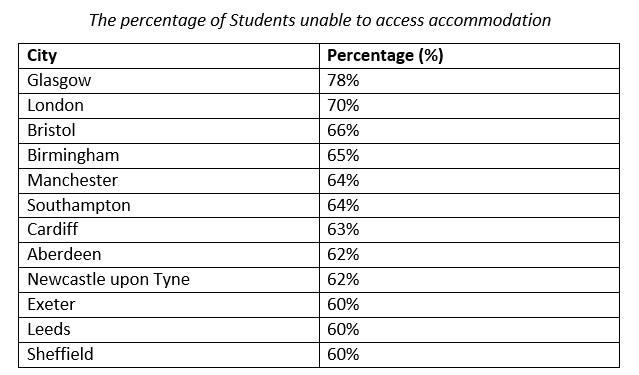

Prospective landlords should target areas with a high population of students and a low supply of student accommodation.

An alternative to buy-to-let accommodation is to invest in purpose-built student accommodation.

“Investors in new schemes such as X1 The Campus in Salford see net yields of 6pc to 7pc and students experience a standard of living that would have been unimaginable a few years ago,” says Jean Liggett, of the buying agency Properties of the World."